Berkshire Hathaway: Insurance Losses Drag Down Second-Quarter Operating Earnings

Berkshire Hathaway reported that operating earnings, a figure which excludes volatile investment gains and derivative fluctuations, declined 11% to $4.1 billion in the second quarter compared to the year-ago period. Net income, which includes investment gains, fell 15% to $4.3 billion. A drop in insurance underwriting profit led the decline in operating earnings and net income.

Berkshire Posts Mixed Results as Expenses Rise

Wide-moat-rated Berkshire Hathaway released second-quarter results that were more mixed than we had expected, with the company reporting solid top-line but weaker bottom-line results. We do not expect to change our $290,000 ($193) per Class A (B) share fair value estimate.

Second-quarter (first-half) revenue increased 6.0% (15.3%) to $57.5 ($122.7) billion. Excluding the impact of investment and derivative gains (losses), second-quarter (and first-half) revenue increased 7.3% (and 16.5%). With expenses increasing at a higher rate than revenue during the second quarter, operating earnings declined 10.6% during the period, leaving first-half operating earnings down 8.0%. Net earnings, which includes the impact of investment and derivative gains (losses) were down 14.8% and 21.4% during the second quarter and first half of the year, respectively.

That said, we remain impressed with Berkshire's ability to increase its book value per Class A equivalent share--which rose 14.3% year over year to $182,816 (better than our own estimate of $182,525)--aided primarily by the strong performance of its equity investment portfolio during 2017. The company closed out the second quarter with $99.7 billion in cash on its books, up from $96.5 billion at the end of March and $86.4 billion at the end of 2016.

Berkshire Hathaway Energy Earnings Up on Solar Rebound

Berkshire Hathaway Energy reported a $38 million increase in earnings for the second quarter over a year earlier, largely because of improved performance of BHE Renewables.

The renewable unit saw net income increase $39 million due primarily to higher generation at the Solar Star projects, which were hobbled by transformer-related forced outages in 2016. It also benefited from earnings from tax equity investments reaching commercial operation and additional wind and solar capacity placed in service. [...]

Warren Buffett's Old Retail Businesses Are Oddly Doing Well as Amazon Runs Over Everyone

While bricks-and-mortar retail is largely a disaster, billionaire investor Warren Buffett seems to have struck gold again—in Berkshire Hathaway Inc.'s retail businesses. [...]

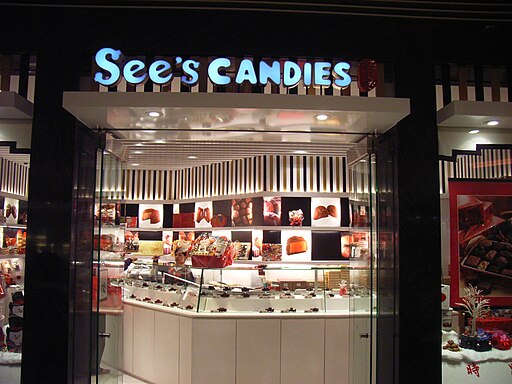

Berkshire, too, reported, within its retail segment, that revenue from its home-furnishing retailers [such as Star Furniture and Jordan's Furniture], online kitchen and cooking supplies seller Pampered Chef and candy maker See's Candies, rose in the second quarter. [...]

Berkshire's retailers are set up primarily as standalone stores or are online, and are not tied to malls, which makes the business less exposed to the downturn in the industry. [...]

With e-commerce hurting malls, See’s Candies seeks way forward

[...] Nearly half of See's 240 stores are located in malls, a format suffering from dwindling traffic and the financial stress of anchor tenants like department stores. [...]

The company does not release financial results, but CEO Brad Kinstler tells me See's annual sales typically grow in the mid-single digits. IBISWorld research firm estimates that See's generated about $485.3 million in revenue last year, representing 5 percent annualized growth rate over the past 5 years.

The synergies between making and selling chocolate, combined with low cocoa prices, affords See's with robust profit margins, IBISWorld says. The firm estimates that See's controls about 31.4 percent of the specialty chocolate retail market, far ahead of Godiva (18.4 percent) and Lindt & Sprungli (10 percent). [...]

Kinstler insists that See's draws its own traffic, independent of the mall anchors. But he does acknowledge that the struggles of malls pose potential problems for his company.

"It’s a tough time to operate a business inside a mall," Kinstler said. "It will take a while before we know what indoor malls look like in the future." [...]

Berkshire Hathaway sets up specialist insurer in Dublin

Berkshire Hathaway has established a speciality insurance business in Ireland aimed at winning a share of the commercial insurance market here . The company will target larger business clients in sectors such as commercial property, general commercial liability, healthcare liability and finance. [...]

BHSI [Berkshire Hathaway Specialty Insurance] is part of the global empire of Berkshire Hathaway, the giant US company led by Warren Buffett, which has stakes in major businesses worldwide. The move to Ireland is an expansion of its existing European speciality insurance business, run from London, which provides commercial property, casualty, executive and professional lines, including cyber and healthcare liability insurance. [...]

Paxton shoots down loophole for Buffett’s Texas dealerships

Texas Attorney General Ken Paxton is declining to come to the rescue of Warren Buffett’s automobile dealerships in the state.

In an opinion issued late Monday afternoon, Paxton essentially said that legal semantics are unlikely to be successful in helping Buffett’s Berkshire Hathaway conglomerate maneuver around a Texas law that appears to prohibit it from owning dealerships in Texas because it also owns an Indiana-based manufacturer of recreational vehicles. [...]

Buffett's Profit From This Paint Company Has Been Almost Wiped Out

Warren Buffett’s profits from a 2015 investment in Axalta Coating Systems Ltd. have been fading.

Axalta, the maker of paint for autos, plunged 7.9 percent Thursday in New York to $29.25. That compares with the $28 price that Buffett’s Berkshire Hathaway Inc. agreed to pay two years ago for 20 million shares, for a total of $560 million. His Omaha, Nebraska-based company acquired the stock from affiliates of Carlyle Group LP. [...]

Berkshire was the largest investor in the coatings company as of Dec. 31, with a stake of more than 9 percent, according to a filing from Philadelphia-based Axalta. [...]

Berkshire Hathaway Inc. Stock Is Increasingly Less About Buffett

Berkshire Hathaway was so big, and commanded so much capital, that many of his ideal picks might only end up as a rounding error on the book value of the stock. So he changed course. He hired two “young guns,” as he called them, and turned over two small portions of Berkshire Hathaway’s capital to manage.

Todd Combs and Ted Weschler continue to out-gun their boss, not by being particularly better, but rather by doing what Buffett used to do when Berkshire Hathaway was new and small. They bought stocks that were classic Buffett. And since their funds were relatively small — at a billion dollars or so — they could at least make an impact on their portion of Berkshire’s stock value. [...]

But now, Buffett as well as Combs and Weschler are changing course. The new course will be to de-emphasize stock selection and in turn run the company as a collection of its operating businesses. This will effectively make Berkshire Hathaway more of a traditional big conglomerate company rather than a stock-picking investment company. [...]