Merry Christmas, Happy Hanukkah, and Seasons Greetings!

Berkshire Hathaway’s Citizenship: Culture, Scale and the Future (Triple Pundit)

This is an excerpt from the book, "Berkshire Beyond Buffett: The Enduring Value of Values."

The companies owned by Berkshire Hathaway, the huge conglomerate that Warren Buffett built, follow their leader in embracing corporate social responsibility, stewardship and sustainability. But the breadth and scale of the sprawling conglomerate can hide both the commitments and periodic problems. [...] While Berkshire has won plaudits for good corporate citizenship, critics complain about the absence of conglomerate-wide reporting on items such as social responsibility and sustainability. Many Berkshire subsidiaries — including Brooks, Johns Manville, Lubrizol and Shaw — are in the vanguard of such corporate stewardship. They join elite global companies in the practice of issuing formal responsibility and sustainability statements and audited reports on the corporate treatment of stakeholders, especially employees at home and abroad, and of the environment.

All of Buffett's bad bets add up to a big year (CNBC)

Some of Warren Buffett's big stocks bets have tanked in 2014, and the market hasn't let it pass unnoticed. In fact, anytime a stock Buffett owns declines, the "billions being lost" by Warren makes it into the headlines. With all the fuss over Warren Buffett's stock-picking prowess, or lack thereof, you might think Berkshire Hathaway has suffered mightily. You'd be wrong, though—way wrong. In fact, Buffett has plenty of reason to smile: Berkshire Hathaway is crushing the S&P 500. [...] While the headlines may not overstate the actual size of potential losses on individual stocks, they do overstate the importance of those losses to Berkshire Hathaway as a corporation. "Most investors overestimate the significance of Berkshire's equity portfolio," said Meyer Shields, Stifel analyst.

Buffett’s Backup Stock Pickers Stumble as GM Declines (Bloomberg)

At least half a dozen stocks that Ted Weschler and Todd Combs probably picked for Berkshire Hathaway Inc.’s portfolio are poised to end the year lower than where they started. They include energy companies that have slumped with oil prices; automaker General Motors Co., which has struggled with recalls; and Chicago Bridge & Iron Co., an engineering and construction firm that’s down more than 50 percent since Dec. 31. “It appears, on first glance, that Todd and Ted have underperformed the S&P 500 this year,” said David Kass, a professor at the University of Maryland’s Robert H. Smith School of Business who has studied Berkshire’s portfolio.

Buffett Reminds His Top Managers: Reputation Is Everything (WSJ MoneyBeat)

Warren Buffett‘s “All-Stars” are getting their biennial reminder this month that they need to guard Berkshire Hathaway Inc.'s reputation–and plan for the future. Mr. Buffett, who’s run Berkshire for the past five decades, sends a memo every other year to the managers of each of Berkshire’s 80-plus subsidiaries that emphasizes those two points. [...] The latest memo also reminds the managers–who he’s dubbed “The All-Stars”–to keep him in the loop about “who should take over tomorrow if you should become incapacitated overnight.” Generally, the managers operate with a large degree of autonomy, and Mr. Buffett says elsewhere in the letter that they can “talk to me about what is going on as little or as much as you wish.” But Mr. Buffett himself takes responsibility for keeping a roster of potential replacements for each of the leaders of Berkshire’s far-flung operations.

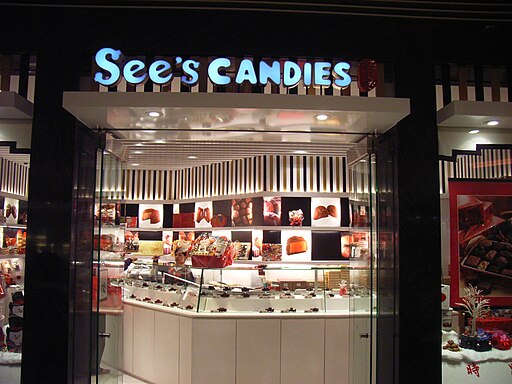

See’s Candies CEO eyes East Coast expansion (San Francisco Business Times)

See's Candies President and CEO Brad Kinstler, speaking after appearing on a Stanford University panel discussion this month, said he's eager to one day replicate the company's California success on the East Coast. But he's not saying when that will happen, noting that See's Candies shops can be found as far east as Pittsburgh. The South San Francisco-based company also operates temporary locations in East Coast cities during holidays when chocolates are in demand.

BYD Says Berkshire Hathaway Has No Intention to Cut Stake (Morningstar)

Chinese electric-car maker BYD Co. Ltd. (1211.HK), which is backed by investor Warren Buffett, Friday said Mr. Buffett's Berkshire Hathaway Inc. (BRKA) has no present intention to cut its stake in the company. BYD also said it wasn't aware of a substantial share sale by Mr. Buffett, who holds 225 million H shares in the company. The car maker's statement comes a day after its Hong Kong-traded shares plunged as much as 47%. BYD said its business operations remain normal and that it hasn't incurred substantial foreign exchange losses despite the weaker Russian ruble.

Berkshire Energy Fined for Eagle Deaths at Wyoming Wind Farms (Bloomberg Businessweek)

PacifiCorp, one of the utilities owned by Berkshire Hathaway Inc.’s energy unit, agreed to pay $2.5 million to settle charges that its wind facilities in Wyoming killed eagles and other birds. The deaths near the Seven Mile Hill and Glenrock/Rolling Hills wind farms violated the Migratory Bird Treaty Act, according to a statement today from the utility. PacifiCorp said it will pay $400,000 in fines, $200,000 in restitution to the Wyoming Game and Fish Department and $1.9 million to the National Fish and Wildlife Foundation to help protect golden eagles near the facilities.

More information in their Press Release:

PacifiCorp Settles With Federal Government Over Migratory Birds (Press Release)

PacifiCorp has been cooperating with federal authorities to reduce migratory bird mortality, particularly eagles, at its wind facilities. Following guidelines issued by the U.S. Fish and Wildlife Service in 2012, PacifiCorp drafted migratory bird protection plans and hired qualified wildlife observers to monitor the wind sites for eagle activity. Operators were notified to shut down turbines to reduce risks when eagles were observed in the area. Other measures the company took included removing features from the project landscape that attract prey species. As part of the settlement, PacifiCorp will take measures at the company’s wind facilities in Wyoming to increase eagle populations.

Pacific Corp To Close Deer Creek Mine (Press Release)

Following an unsuccessful 18-month attempt to sell the Deer Creek coal mine, PacifiCorp announced today it will close the mine in Emery County, Utah, because it has become too costly to operate for customers. PacifiCorp also signed a long-term coal supply agreement with Bowie Resource Partners LLC to supply coal for the Huntington power plant. Energy West Mining Company, PacifiCorp’s subsidiary operator of the mine, notified the mine’s 182 workers of the pending closure. [...] The Deer Creek mine has an estimated five years or less of reserves, but much of the remaining coal has higher ash and sulfur content that has made mine production considerably more expensive and has made it more expensive to comply with air quality standards. Bowie Resource Partners LLC has signed a contract to provide the coal needed for the Huntington power plant, and will source the plant from its mines in Utah. Rapidly escalating pension liabilities for the mine’s represented workforce was a large factor in the economic viability of the mine.

Buffett’s Smart-Grid Idea Takes Over Your Washing Machine (Bloomberg)

Buffett’s Northern Powergrid Holdings Co. is working with Siemens AG to test a so-called smart grid that has the ability to control when consumer appliances will be used in the home. Being able to better manage when electricity flows allows utilities to lower consumer costs by reducing the need for new equipment, and to better handle surges and gaps from intermittent sources such as wind and solar. The pilot program, known as the Customer-Led Network Revolution, involves just 12,000 households in the U.K. and is one of only a few such projects being tested worldwide.

Warren Buffett said 'I loved it' when LeBron James rejoined the Cleveland Cavaliers (Cleveland Plain Dealer)

Buffett was seated on the baseline near the Cavaliers bench as a guest of James and, perhaps more so, of owner Dan Gilbert, who sat next to Buffett. He watched James score 27 points, dish out 13 assists, and grab seven rebounds, then chatted with James and Gilbert in the locker room afterwards. Buffett, 84, chief executive officer of Berkshire Hathaway, is the second-richest man in the United States with a net worth of $71.6 billion, according to Forbes.com. He was donning a white No. 23 Cavaliers jersey Monday night. On Sunday, he attended a Detroit Lions football game and wore a No. 90 jersey for the Lions' Ndamukong Suh.