Warren Buffett has a year to forget (CNN Money)

Warren Buffett's Berkshire Hathaway is on track for its worst year since 2008. Shares of Berkshire's A and B shares are each down about 13% so far in 2015. [...] The last time the Oracle of Omaha's company did so poorly was in 2008, when both classes of Berkshire's stock fell 32%. [...]

This year, Buffett is lagging the market. The S&P 500 is down ... but only by 2%. The last time that Berkshire had a down year and underperformed the S&P 500 was all the way back in 1999. That year, the S&P 500 gained 19.5% while Berkshire's A shares fell 20% and the B shares were down 22%. [...]

A Fresh Peek at Berkshire Hathaway's Hot Portfolio and Valuations (Market Realist) A seven part series... just keep scrolling down the page for other installments. Lots of good analysis of the various business units.

Berkshire Hathaway, with a market capitalization of more than $335 billion, is a holding company whose subsidiaries engage in diverse business activities across sectors. The following are the major businesses where its subsidiaries operate: insurance and reinsurance, freight rail transportation, utilities and energy, finance, manufacturing, service and retail [...]

Buffett's NetJets Wins Agreement From Pilots Union on Contract (Newsmax Finance)

NetJets, the luxury aviation business at Warren Buffett’s Berkshire Hathaway Inc., just won over its pilots union, ending a dispute that’s stretched on for years.

Members of the NetJets Association of Shared Aircraft Pilots, which represents more than 2,700 pilots who fly for the business, voted to ratify a new contract with the company, the union said Sunday in a statement. Of the pilots who voted, more than 75 percent endorsed the agreement, the union said.

The deal included a double-digit increase in average wages, a signing bonus and a continuation of company-funded health care, among other benefits. Negotiations had been a sore spot over the past few years for Buffett, Berkshire’s billionaire chairman and chief executive officer. [...]

How Buffett Turned Around A $23.5 Billion Insurance Bet (Fool)

Berkshire Hathaway's insurance companies are worthy of envy. Large, profitable, and responsible for generating billions of dollars for Buffett to invest, the insurance group at Berkshire Hathaway underlies much of its recent and historical success. [...]

In fact, in the last 10 years, three of four of its insurance units have been profitable in every single year. One, Berkshire Hathaway Reinsurance, lost money in just one of the last 10 years.

This result is simply phenomenal. When investment income earned from Berkshire's float is included, the insurance companies have been profitable in 17 out of the last 18 years. [...]

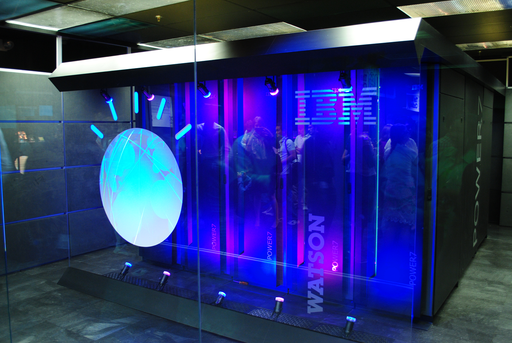

Why Wall Street is Wrong and Warren Buffett Is Right About Beaten-Down IBM (The Street)

For confirmation, look no further than Warren Buffett, who seems to understand IBM's hidden potential. Buffett's Berkshire Hathaway boosted its stake in IBM by roughly 2% in the third quarter to 81 million shares from 79.6 million, for a value of about $11.7 billion. That makes IBM Berkshire Hathaway's fourth biggest holding. [...]

But here's what most investors are missing and what Warren Buffett understands: IBM is in the midst of a profound corporate reinvention that will soon bear fruit. The company is shedding its declining hardware businesses to emphasize the higher-margin areas of cloud computing, analytics and big data. [...]

Buffett endorses Clinton, likens Republican debate to vaudeville (Chicago Tribune)

He also singled out Republican front-runner Donald Trump for bragging "every five minutes" about how smart he is.

"Incidentally, I went to Wharton, too," Buffett said, referring to the University of Pennsylvania's business school, which Trump attended. "And I left after two years to go to the University of Nebraska." [...]