The quarterly 13F came out last week, detailing the changes in Berkshire Hathaway's portfolio last quarter. Dataroma has a convenient chart to visually show what changed.

Berkshire Hathaway Reduces Goldman Sachs, Wal-Mart Stakes (ABC)

Buffett told CNBC on Monday that the main reason he reduced Berkshire's stakes in Wal-Mart Stores Inc. and Goldman Sachs Group Inc. was to generate cash for his $32 billion acquisition of Precision Castparts Corp. that's expected to close next year. [...]

Warren Buffett is having an unusually bad year (CNBC)

Warren Buffett has seen shares of his Berkshire Hathaway fall more than 11 percent this year. Even worse, Berkshire shares have underperformed the S&P 500 by more than 10 percent.

What makes this highly unusual is that Berkshire famously tends to underperform when the S&P skyrockets and outperform when the stocks as a whole do less well, which makes sense given Buffett's long-term time frame. [...]

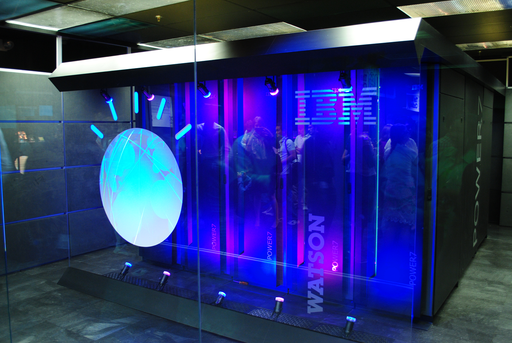

Buffett Doubles Down on Big Blue (Fool)

To me, and presumably Buffett, as well, there's a readily identifiable disconnect with IBM's very gradually declining core business and the huge discount the market has placed on the company's future outlook. For context, IBM stock currently trades at a remarkably low 9.5x its LTM earnings, and yields 3.9%. Wall Street analysts expect IBM's revenue to continue to fall into next year, but believe that Big Blue will actually return to EPS growth in 2016. That reversal alone could be enough to inject some much-needed optimism into IBM shares, even as its broader business realignment requires more time to fully materialize.

Is Warren Buffett Still a Bargain Hunter? (CNN Money)

Consider Axalta Coating Systems, which makes automobile finishes and other coatings. [...] Axalta sells for a whopping 130 times its past 12 months of earnings and sports a price/earnings ratio of 22 based on future estimated profits. [...]

On paper, this would hardly seem like a stock that a vaunted bargain hunter would gravitate to. Yet Axalta isn’t the only example.

Berkshire Hathaway [Travel Insurance] expanding again (Insurance Business)

Insurance giant Berkshire Hathaway Travel Protection (BHTP) teamed up with VacationGuard, a specialist provider of vacation rental insurance, this week to create customized travel insurance products for timeshares, travel clubs, resorts and vacationers.

Targeted at both property owners and vacation renters, the products protect against trip cancellation, delays, injuries and accidental damage to rental units.

Fire at Leetsdale chemical plant leads to 70 homes being evacuated (Pittsburgh Post-Gazette)

Residents were evacuated from more than 70 Leetsdale homes Tuesday after a fire at a chemical manufacturing plant filled the sky with black smoke and noxious fumes.

Four workers at the Lubrizol Corp. Oilfield Chemistry site in the Leetsdale Industrial Park were adding chemicals used in gas well fracturing to a production tank about 10 a.m. when the fire exploded to life, a company spokesman said. The workers — and about 36 other employees — escaped the buildings, though five of the workers were injured.

Buffett’s Grandson Seeks Own Investment Route: Social Change (NY Times)

At 32, Howard Warren Buffett, the grandson of the Berkshire Hathaway founder Warren E. Buffett, has already enjoyed a diverse career. He teaches at Columbia University, runs a farm in Nebraska, previously oversaw his family’s foundation and worked on economic redevelopment efforts in Afghanistan for the Defense Department. [...]

Now, that is changing. Mr. Buffett has co-founded a permanently capitalized operating company with big ambitions [...] The plan is for the new company, called i(x) Investments, to invest in early-stage and undervalued companies that are working on issues such as clean energy, sustainable agriculture and water scarcity. [...]

Berkshire gets flak from ClimateTruth, others for solar panel policy (Omaha World-Herald)

A climate activist group said Tuesday that Berkshire Hathaway Inc.’s utility division favors policies that would hinder the spread of rooftop solar energy panels.

Outside Omaha’s Kiewit Plaza, where Berkshire has its offices, representatives of ClimateTruth.org and other groups gave a security guard what they said was an electronic copy of an online petition with about 100,000 signatures. The petition, addressed to Berkshire Chairman Warren Buffett, said, “End your profit-driven challenges to net metering programs in Nevada and all over the country.”

Prominent film company focuses documentary lens on Buffett (Omaha World-Herald)

Kunhardt Films of Pleasantville, New York, is gathering information, photos and videos about the chairman and chief executive of Omaha-based Berkshire Hathaway Inc.

When the project airs, possibly within two years, Buffett would join a long list of prominent Americans profiled by the film company headed by Emmy winner Peter Kunhardt.